Real Property Records

Real Property Records - Clark County, Nevada

Home Government Assessor Real Property Property Search Real Property Records. Search by one of the following: Parcel Number. Owner Name. Address. Subdivision Name. Subdivision Owners. Parcel Type/Book & Page.

https://www.clarkcountynv.gov/government/assessor/property_search/real_property_records.php

Real Property/Land Records | Bexar County, TX - Official Website

Real Property documents may be filed and recorded with the Bexar County Clerk’s Office in person or by mail. The original documents with original signatures are required for the recording. The County Clerk’s Office will not record a copy. Recordings are completed immediately in the County Clerk’s Office.

https://www.bexar.org/2950/Real-PropertyLand-Records

Property & Real Estate Record Search - realtor.com

Property & Real Estate Record Search Search for sale, rent and off market properties and claim your own home! All States Alabama ( 4012 New Listings) Alaska ( 489 New Listings) Arizona ( 7736 New...

https://www.realtor.com/propertyrecord-search

SDAT: Real Property Data Search<

This screen allows you to search the Real Property database and display property records. Click here for a glossary of terms. Deleted accounts can only be selected by Property Account Identifier. The following pages are for information purpose only. The data is not to be used for legal reports or documents.

https://sdat.dat.maryland.gov/RealProperty/Pages/default.aspx

Real Property / Lubbock County, Texas

Real Property records are public information, if you have a local contact, they are welcome to come into our office and get the copies for you. Our regular business hours are M-F 8:30 a.m. to 4:30 p.m. located at 904 Broadway, Room 207 in Lubbock. Requesting Copies from Real Property Online and Payment by Credit Card

https://www.lubbockcounty.gov/department/division.php?fDD=2-8

Harris County Clerk's Office

The Real Property Department records documents pertaining to real property or real estate in Harris County. The Harris County Clerk’s Office has the ministerial duty to accept a document for recording if a statute authorizes, requires, and permits it to be filed. Real Property Real Estate Information Harris County Clerk Fee Schedule

https://www.cclerk.hctx.net/RealProperty.aspx

Real Property - Washoe County

The statute requires the Assessor to reappraise each real property at least once every five years. Currently, the Washoe County Assessor's Office is reappraising each property annually. The total taxable value cannot exceed the "full cash value" (market) of the property as defined by N.R.S. 361.025.

https://www.washoecounty.gov/assessor/real_property/index.php

Real Property - Maryland Department of Assessments and Taxation

About Real Property In Maryland, there are more than two million property accounts. The Department of Assessments and Taxation must appraise each of these properties once every three years. There are 24 local State assessment offices, one in each county and Baltimore City.

https://dat.maryland.gov/realproperty/Pages/default.aspx

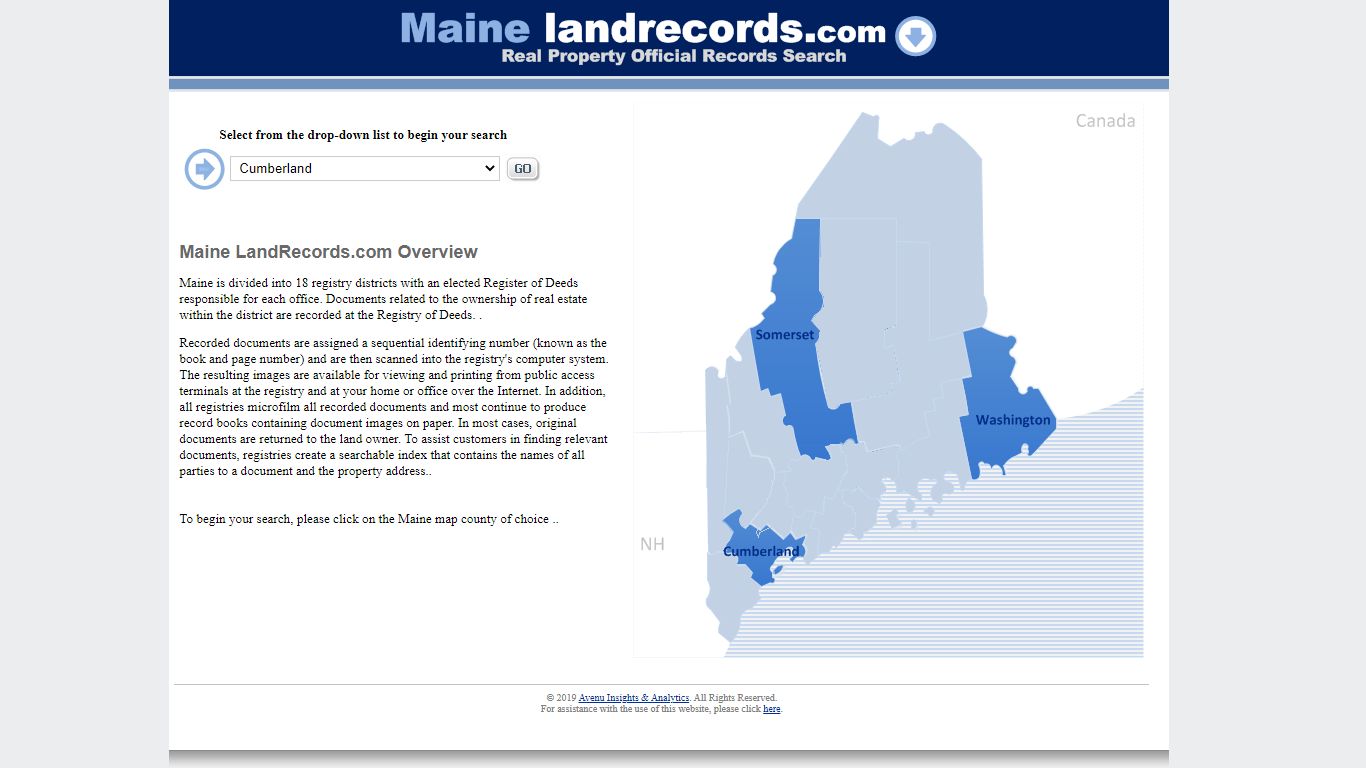

Maine Real Property Official Records Search

Maine Real Property Official Records Search Maine LandRecords.com Overview Maine is divided into 18 registry districts with an elected Register of Deeds responsible for each office. Documents related to the ownership of real estate within the district are recorded at the Registry of Deeds. .

https://i2a.uslandrecords.com/ME/

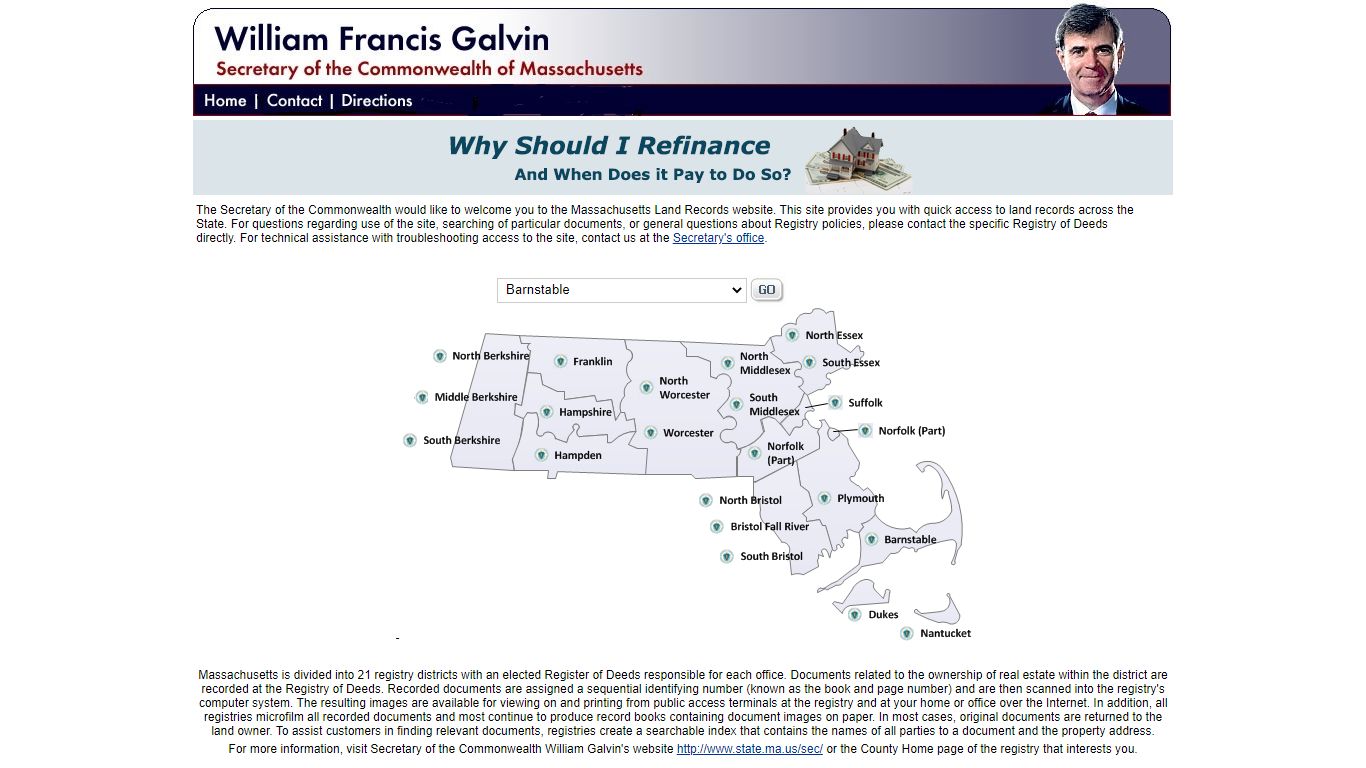

Massachusetts Land Records

Massachusetts Access property records, Access real properties The Middlesex South Registry of Deeds is opening for normal business hours today at its location of 208 Cambridge St in Cambridge. The Secretary of the Commonwealth would like to welcome you to the Massachusetts Land Records website.

https://www.masslandrecords.com/

Real Property - City and County of Denver

Under Colorado law, all counties must reappraise real property every two years. Results are released in odd-numbered years (2019, 2021, etc.). By May 1 of each year, Notices of Valuation are sent to real property taxpayers whose values have changed since the prior year. If this value appears incorrect, the taxpayer may protest the assessment.

https://www.denvergov.org/Government/Agencies-Departments-Offices/Agencies-Departments-Offices-Directory/Department-of-Finance/Our-Divisions/Assessors-Office/Real-Property